Business Insurance in and around MONROE

Researching coverage for your business? Search no further than State Farm agent Ashley Johnston!

Cover all the bases for your small business

State Farm Understands Small Businesses.

Running a small business comes with a unique set of challenges. You shouldn't have to face those alone. Aside from just your loved ones, let State Farm be part of your line of support through insurance options including a surety or fidelity bond, extra liability coverage and worker's compensation for your employees, among others.

Researching coverage for your business? Search no further than State Farm agent Ashley Johnston!

Cover all the bases for your small business

Keep Your Business Secure

At State Farm, apply for the fantastic coverage you may need for your business, whether it's a drug store, a veterinarian or a toy store. Agent Ashley Johnston is also a business owner and understands what you need. Not only that, but exceptional service is another asset that sets State Farm apart. From one small business owner to another, see if this coverage takes the cake.

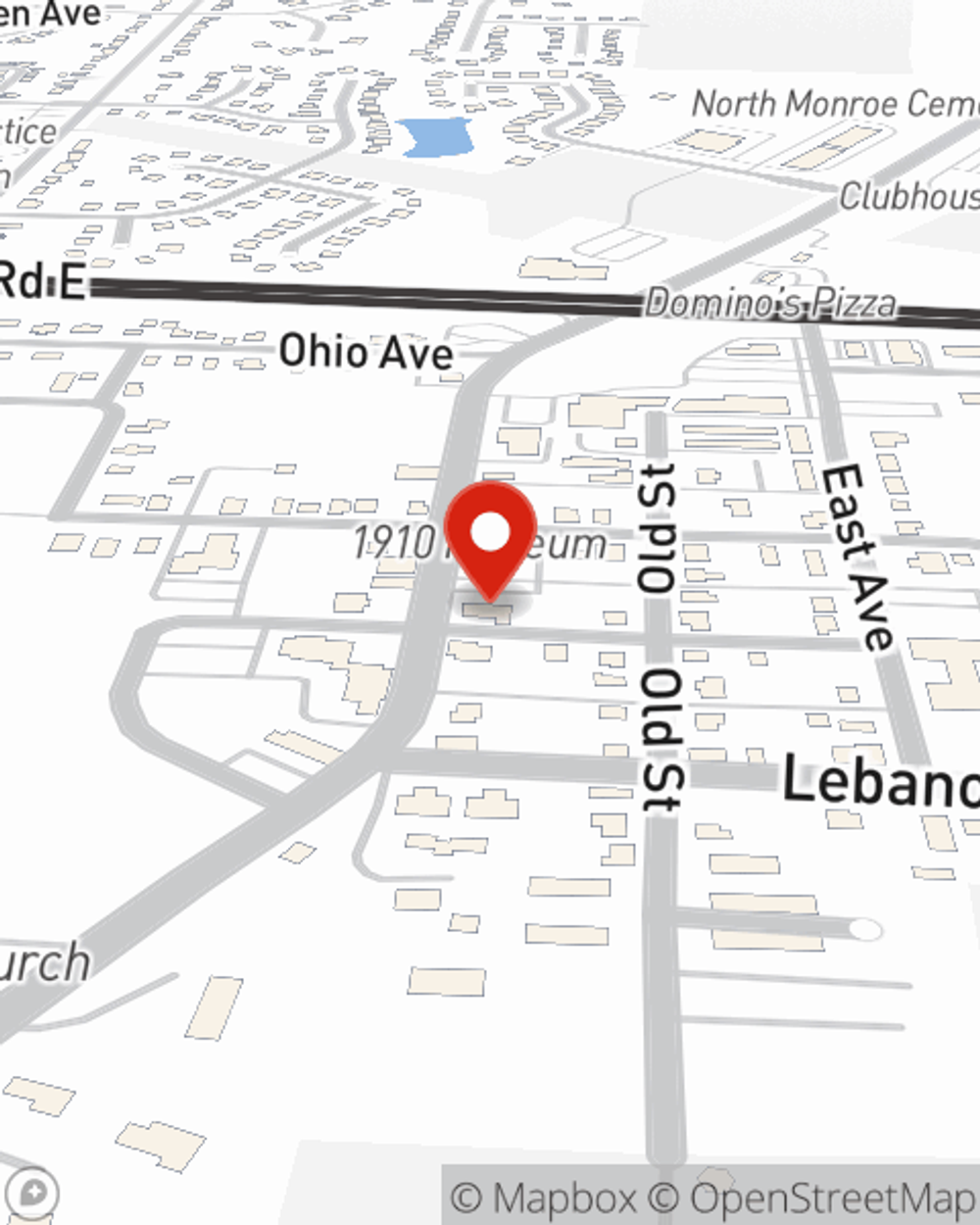

Ready to review the business insurance options that may be right for you? Reach out agent Ashley Johnston's office to get started!

Simple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

Ashley Johnston

State Farm® Insurance AgentSimple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.